Ethereum is planning to move from proof-of-work to proof-of-stake next month. As someone who has participated in large open-source projects before, it's impressive that the developers were able to make such a drastic shift to the network. Here's what you need to know.

- There will no longer be any Ethereum mining. This should substantially lower the energy requirements of the network.

- Instead, incentives will be allocated by staking or depositing your Ethereum into nodes. Anyone can do this or join a pool (although the minimum is 32 ETH to run your own).

- You currently can't withdraw your staked eth. There are plans to add the ability to unstake it in a future fork. See Costs of Participating in Decentralized Networks.

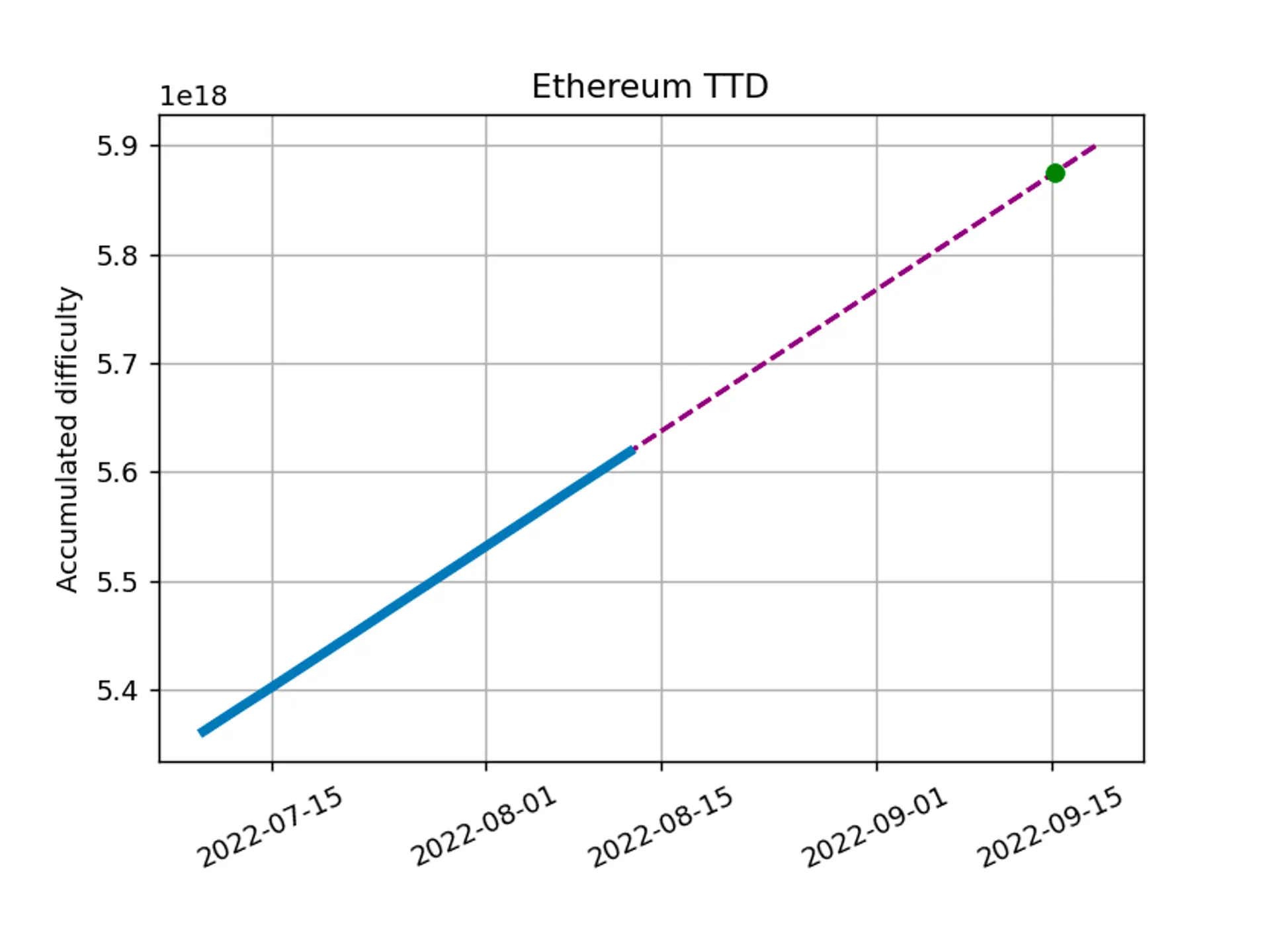

- The exact date is unknown because the network will switch at a total terminal difficulty (a function of the hash rate) of

5.875e22, which is predicted to be September 14th, 2022.

- Ethereum still makes the same tradeoff in regards to availability vs. consistency.

- Tokens issued as rewards will decrease over time. This means that Ethereum will become deflationary at some point – the burn rate will be greater than the mint rate.

Some open questions:

What happens to the miners? There are companies that have invested significant resources into physical hardware that will now be useless (for Ethereum). Some predict they will hard fork the chain and continue operating the existing chain using the state before the merge. When Ethereum faced a massive hack in 2016, the developers chose to reverse the transaction and hard fork the chain. The original chain, Ethereum Classic, still lives on with an unaltered history, and the Ethereum Classic Token market cap is non-zero (~$2 billion).

What are the risks of proof-of-stake? Ethereum doesn't have on-chain governance, so a malicious actor couldn't change the rules. However, with 33% of the total Ethereum staked, you could halt the network and prevent new transactions from happening. With 66%, you could validate malicious blocks. Compare this to the 51% attack in traditional proof-of-work blockchains.

Other chains already run proof-of-stake, but none as large as Ethereum. It will be interesting to see the outcome of the merge. There are a lot of incentives and stakeholders (pun intended).

I'm optimistic for the developers and ecosystem. Whether or not you believe in the mission, the sophistication of the open-source infrastructure behind Ethereum is impressive. So, if there's a decentralized team to pull this off, it's probably the Ethereum team.

Yet, there are always risks:

Never rewrite the code from scratch.

– Things You Should Never Do by Joel Spolsky