GitLab is one of the world's largest open companies, valued at over $6 billion. The company open-sourced nearly every internal company's OKR, process, and strategy. It may be the best playbook available for aspiring SaaS entrepreneurs. At Stanford Business School, I spent a lot of time crunching the numbers and poring over every one of the 13,804 pages of the handbook (well, I might have skimmed a few). Even better, since the handbook is tracked in version control, I could look to see how it's changed over time. The first post in this series of Gitlab analyses is on Sales Efficiency.

One metric used to compare SaaS companies across different industries is sales efficiency.

Sales efficiency is the amount of new revenue created for every dollar invested in sales and marketing.

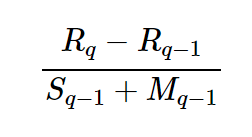

It's such an important number in SaaS that it's sometimes deemed the magic number. It's usually calculated quarter over quarter with something like:

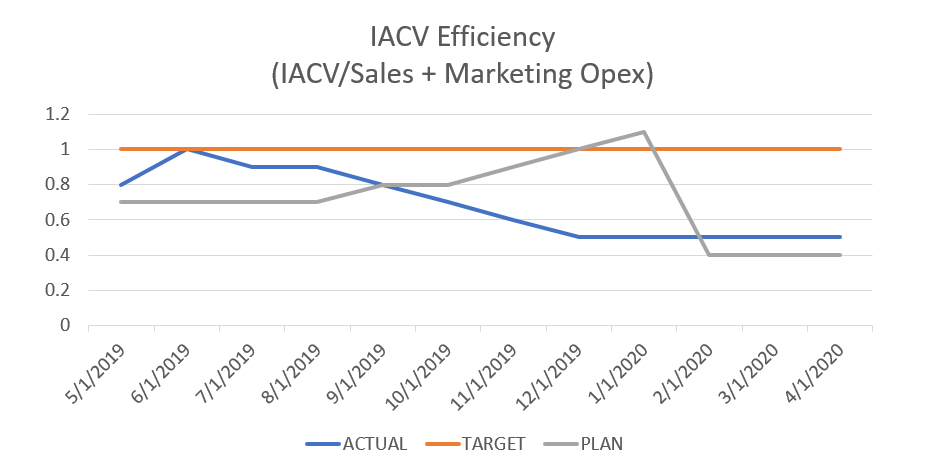

Let's look at how Gitlab calculates sales efficiency. IACV stands for incremental average contract value. It's calculated as New IACV + Growth IACV, where Growth includes new seats, upgrades/downgrades, true-ups, or changes in discounts. The denominator is what we'd expect, sales and marketing operating expenses.

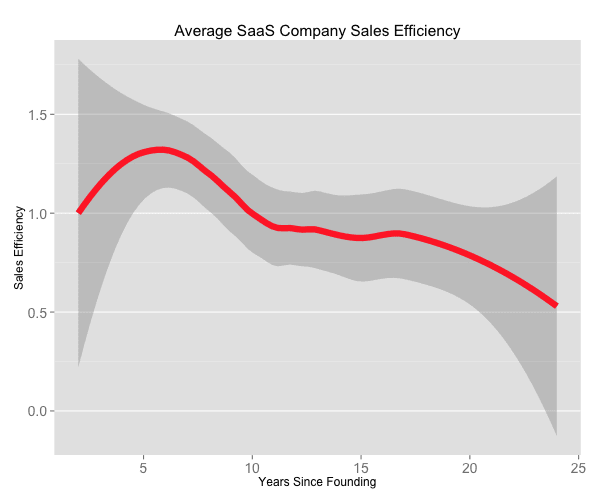

How does that compare to the best public SaaS companies? Here's a great graphic from Tomasz Tunguz's blog. Tomasz is a venture capitalist at Redpoint Ventures and one of the great thinkers on enterprise SaaS.

So you can see that the industry average should be around 0.8. If you convert sales efficiency to a payback period, the business will take five quarters to pay back the sales and marketing expenses. So SaaS companies with a sales efficiency of 0.8 or greater should be looking to grow as fast as possible.

Why was GitLab's sales efficiency lower than usual? One reason could be the difficulty of land expansion revenue from existing contracts. The main product, hosted version control, is relatively cheap compared to other enterprise SaaS solutions.

Another reason could be GitLab's reliance on self-serve revenue for so long. Many companies initially grow with a limited sales team, relying on freemium conversion and "credit card" level plans. It's sometimes difficult for these SaaS companies to transition from bottoms-up to a top-down enterprise sales team (see: Dropbox vs. Box).

This was all during the early days of COVID-19, and these numbers aren't reflective of where the business might be today – only provided to illustrate a point on sales efficiency. GitLab hasn't been publishing these numbers recently.

There's more to this story. Quota and sales incentive plans, win-rate, growth and attribution, and more. More data and analysis to come.