There are only two ways to make money in business: bundling and unbundling — Jim Barksdale, ex-CEO of Netscape.

There are only three ways to make money in business: bundling, unbundling, and writing about bundling and unbundling — Lenny Rachitsky, author of one of the most popular paid Substack newsletters on product management.

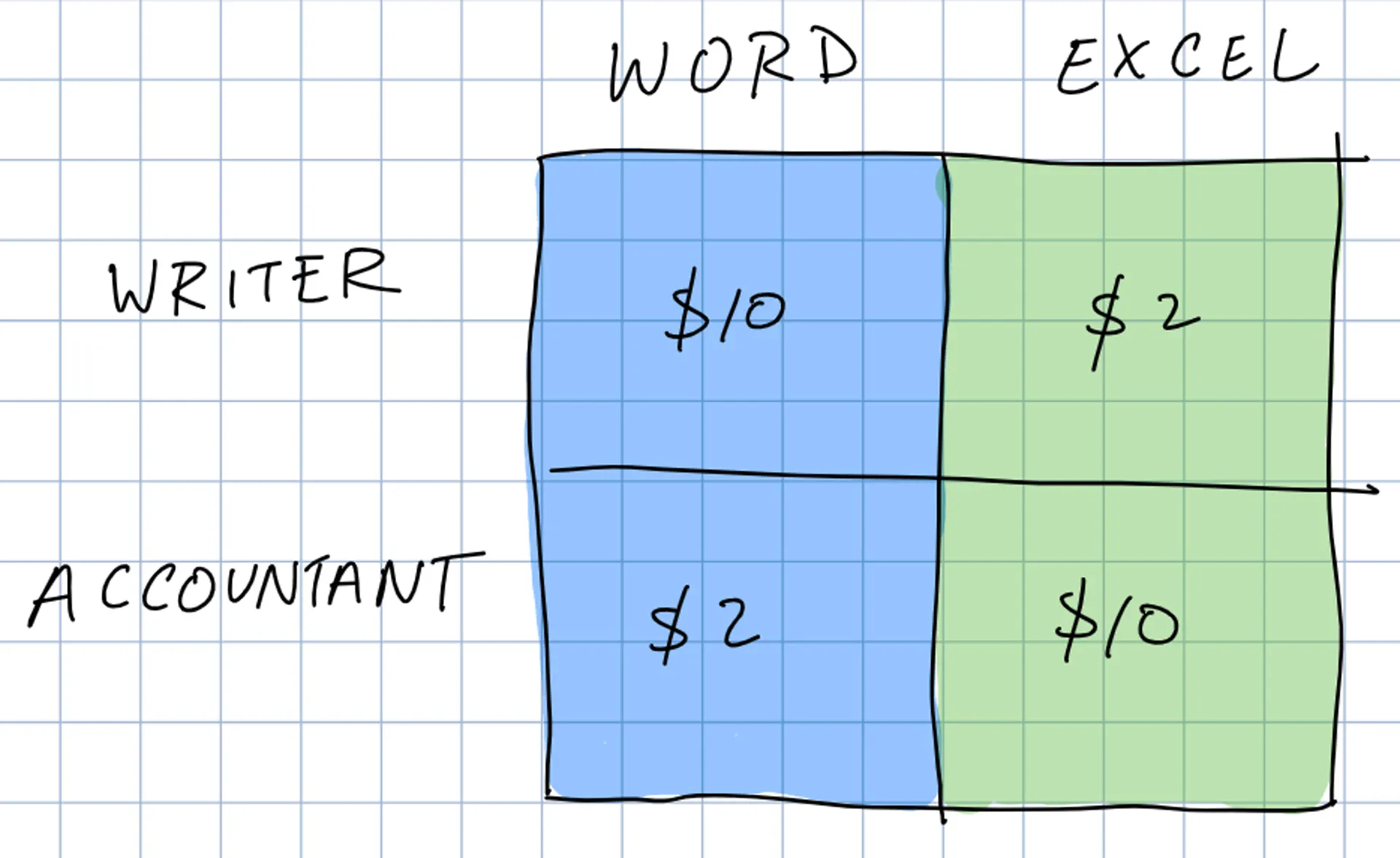

Bundling can make everyone better off, creating surplus for both consumers and producers. Take an example of a word editor and a spreadsheet. A writer is willing to pay ("willingness-to-pay") up to $10/month for a word editor but only $2/mo for a spreadsheet (numbers should be spelled out). An accountant is willing to pay $10/mo for a spreadsheet but only $2/mo for a word editor (who needs to write?).

A big company that produces both a word-editor and spreadsheet can price both products at $10/mo. The writer will purchase the word editor, and the accountant will purchase the spreadsheet (in practice, the price has to be slightly less than the willingness to pay). The company makes $20.

Now assume that the company bundles both products and prices the combined bundle at $11. Both the writer and accountant purchase the bundle since they are willing to pay $12 (valuing their primary product at $10 and the secondary at $2). The company makes $22, and the consumers have a combined surplus of $2 (willing to pay $24, but only had to pay $22).

Bundlers get disrupted by startup unbundlers. Unbundlers grow into big companies, and become bundlers.

Bundles work best for products with low marginal cost, and software has near-zero marginal cost.

Bundled products with high overlapping transaction costs can reduce friction. For example, you install Microsoft Office instead of having to install separate applications. But SaaS and browser-based applications have completely flipped this effect on its head. Now, it's a liability to install desktop applications like Office 365 rather than browse to a web page. There's a limit to the size of desktop application bundles, but SaaS is limitless.

Bundlers get disrupted because of the classic innovators dilemma. As companies grow larger, bundles accumulate. It's easier to stay focused on your core offering and add things to it. Product-centric growth becomes distribution-centric growth.

First time founders are obsessed with product.

Second time founders are obsessed with distribution.

— Justin Kan (@justinkan) November 7, 2018

The problem with distribution is that sometimes the technology shifts beneath you. For example, newspapers and traditional media companies were probably one of the best distribution monopolies in history but now have been almost completely disrupted. Microsoft used to bundle applications on its operating system. Now, as most software is accessed over the internet, through web browsers, the operating system isn't as effective of a distribution mechanism.

In practice, companies don't exactly know the distribution of consumers' willingness-to-pay a priori (in some cases, ever). In practice, products are bundled for other reasons: to prevent competition, to act as a loss-leader to gain some strategic advantage, or to simplify processes as the easiest solution (Occam's Razor). It would be interesting to explore how bundled products affect internal decision-making at companies — coordination costs, friction to splitting out products, software, and team inter-dependencies.

So, you saw that there is a clear economic surplus to both consumers and producers for bundling. But bundling is a double-edged sword for businesses — it opens the company up to strategic weaknesses it wouldn't have had otherwise. Maybe it's the balance of value creation and destruction that keeps us in a cycle of bundling and unbundling.