Imagine you're a venture capital partnership deciding whether to invest in a startup or not. After meeting a promising new startup, a partner comes to the Monday investment committee, but not everyone agrees that it's a worthwhile investment. So what is the optimal decision-making process for the group to maximize their return?

Majority vote? Supermajority? Unanimous? Does anyone have veto power? Can a single individual with high conviction make a unilateral decision?

In practice, it turns out the answer depends partly on the riskiness of the decision being made. Think about it in terms of the probability of a "yes" decision. All other things equal, the more votes needed to pass the proposal lowers the likelihood of success. Veto power diminishes it even more.

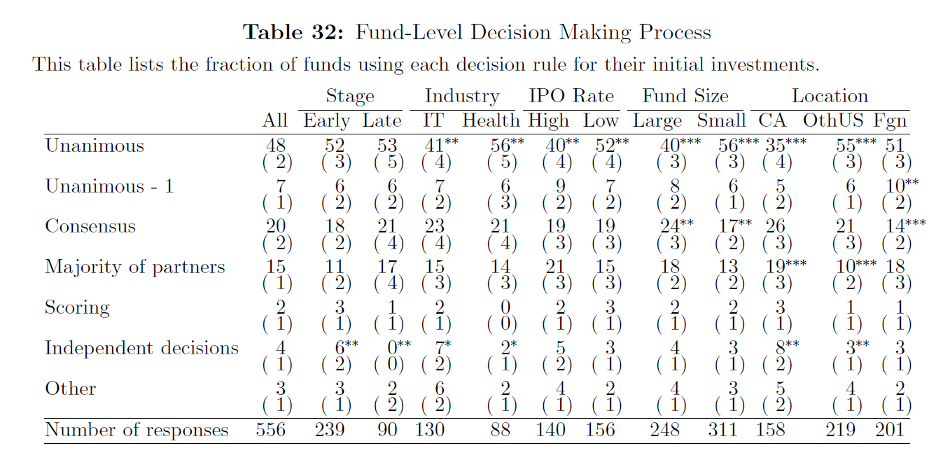

You can observe this by generally looking at the spectrum of early-stage to later-stage venture capitalists (in practice, the decision-making process at firms is more complicated).

Early-stage investors take on more risk. Unproven technologies and markets. Non-consensus bets. It's challenging to get everyone on board for extremely risky decisions. Contrast that with later-stage investors, who (usually) have much more information at their disposal: past performance, market validation, more capital, and lower multiples.

A few simple takeaways:

- There's no one-size-fits-all decision-making process. Instead, it should depend on the risk propensity of the group and the type of decision (e.g., is the decision a one-way or two-way door?)

- There are mechanisms like veto power that can fit different risk profiles.

Since I've spent a lot of time thinking about distributed systems, I have to acknowledge that computers face some of the same issues. Groups often need to make decisions even when some members aren't present (some servers may fail or take too long to respond). Other times, a final decision must be made when there are differing opinions. The correlation between risk and decision-making still applies, even to computers.