The players are different, but the game is the same.

F. Augustus Heinze was the founder of United Copper Company and one of the "Three Copper Kings" of Butte, Montana. United Copper produced 40 million pounds of copper a year. By 1906, Heinze was rich and set his sights on the financial markets.

Heinze had two brothers, Otto and Arthur, who devised a "short squeeze," not unlike the one that happened to GameStop in January 2021. Otto had realized that United Copper had 105% short interest – i.e., 450,000 shares were trading, yet only 425,000 had been issued, the rest borrowed. GameStop had 140% short interest. And Otto Heinze believed that the Heinze family owned most of the outstanding shares.

The plan? Buy stock in United Copper, drive the price up, and force the short sellers to buy back the stock at exorbitant prices. Otto found outside financing from the Knickerbocker Trust Company to execute the short squeeze – he still didn't have enough to purchase all the shares, but that was OK since the Heinze would make up the margin in the short squeeze.

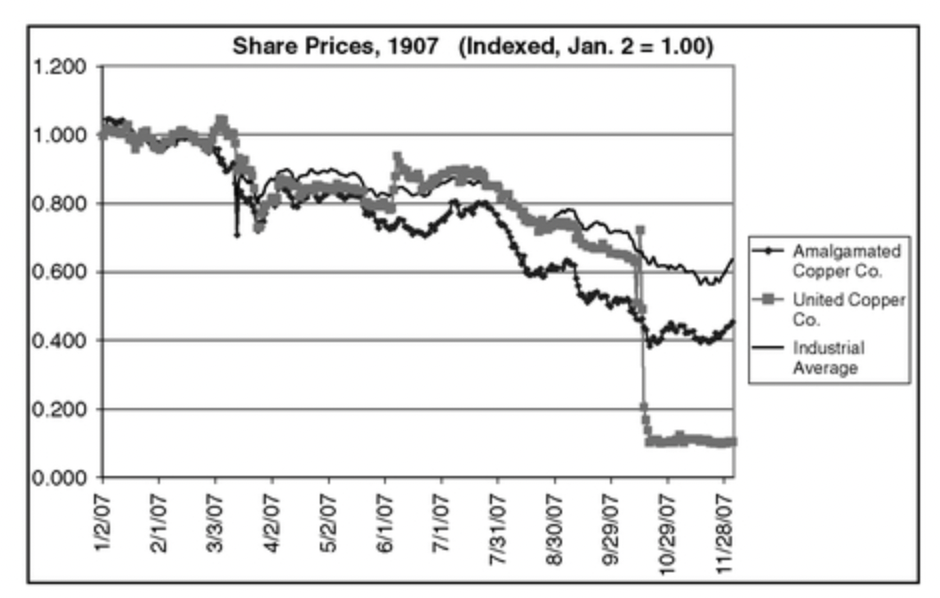

Monday, October 14th, 1907 – The markets were quiet. United Copper opened at $39⅞. Then the bidding started. By 10:50 A.M., the stock rose to a high of $60 before falling back to $50.

Tuesday, October 15th, 1907 – The stock opened lower at $50. Then, Otto executed his plan – he called for the brokers to deliver their stock by 2 P.M. that afternoon. Heinze expected the brokers to be unable to procure the stock and default on their obligations. Then, Heinze could sell it to them and force them to pay the difference.

But Heinze miscalculated. Every one of the twenty brokers could find the stock from buyers other than Heinze. No one defaulted. The short squeeze had the opposite effect – it flooded the market with so much United Copper stock that the market crumbled. From a high of $60, it closed at $38, with no bid.

Wednesday, October 16th, 1907 – The stock opened at $36 and closed at $10.

Otto was bankrupt, and so were his brokerage houses. United Copper's collapse made its bank, the State Savings Bank of Montana, insolvent. The Knickerbocker Trust, which helped finance the squeeze, also collapsed.

The collapse of the Knickerbocker Trust triggered a bank run on other trusts. Nobody was willing to bail these trusts out. Banks stopped making short-term loans to traders. Without funds to trade, the prices on the New York Stock Exchange started to crash. This was the Panic of 1907.

J.P. Morgan bailed out the trusts. He rallied the bank presidents to keep the stock exchange open and infuse funds. He organized an acquisition that saved an over-levered brokerage from going under.

Even the City of New York almost went bankrupt. It was $20 million short of its obligation until J.P. Morgan purchased $30 million of municipal bonds.

After 1907, the United States realized they were vulnerable to another systemic collapse like the Panic of 1907. This was the start of central banking in the U.S. and the development of the Federal Reserve System.