What if the securitization of everything was a natural reaction to rising inequality? My attempt to put the desire for ownership in perspective of macroeconomic theory.

In 2013, economist Thomas Piketty published Capital in the Twenty-First Century with a simple but powerful equation. (The book is surprisingly accessible for a 700-page macroeconomic text).

r > g

When the rate of return (r) is greater than the rate of economic growth (g) over the long term, the result is a concentration of wealth, and this unequal distribution of wealth can cause social and economic instability.

Another way to put this is that the return from having capital (through interest, stocks, housing, or other assets) will outpace the return from labor (i.e., working). When this happens, "the rich get richer, and the poor get poorer" (the Matthew Effect, no relation to this Matt).

Piketty's theory captured public interest in a way that no macroeconomist has since. But, of course, it wasn't without its critiques – much of the return on capital could be attributed to home prices, and the top 1% is still made up mostly by salaries [1].

Let's suspend disbelief and assume Piketty was correct. What if inequality was an inevitable side-product of capitalism? The Gini coefficient is increasing, and rising inequality can be seen from education to the markets. Piketty's solution was more progressive taxes. I believe the market is coming to its own answer.

- Everything is becoming securitized. Digital currencies and derivatives, tokens representing services or digital art or membership, and even your future income through income-share agreements (ISAs).

- Everything that is securitized is becoming fractionalized. Vehicles to fractionalize larger assets like real estate can let more people access higher-value assets, increasing liquidity and possibly market surplus. Fractional shares of stock can make high-priced equities like Berkshire Hathaway $BRK.A accessible to the retail investor (one full share currently trades at $444,654). Angellist offers roll up vehicles that allow would-be angel investors the ability to invest in the venture asset class easily.

- Everything that is securitized is becoming democratized. Trades used to cost a few dollars to execute, essentially pricing out retail investors on the lowest end. Now, nearly every trading platform offers free trades. Most investors in digital assets like cryptocurrencies and NFTs aren't technical (anecdotal, probably needs a reference).

At the core of the securitization of everything is a desire for ownership. However, I'm unsure what end of the r > g equation this supports.

On the one hand, it unlocks new r for new investors – even the smallest investors can access more asset classes and potentially put more of their capital or expertise to work.

On the other hand, it increases g in a variety of ways. We are creating liquid markets. New technology shows up in our productivity measure (TFP) eventually. While we can't measure improvement from a free service like Google directly, the securitization and ownership of everything might let us track it more easily.

Is it adding to inequality or an attempt to solve it? Looking at some individual movements like cryptocurrency and retail investing, no.

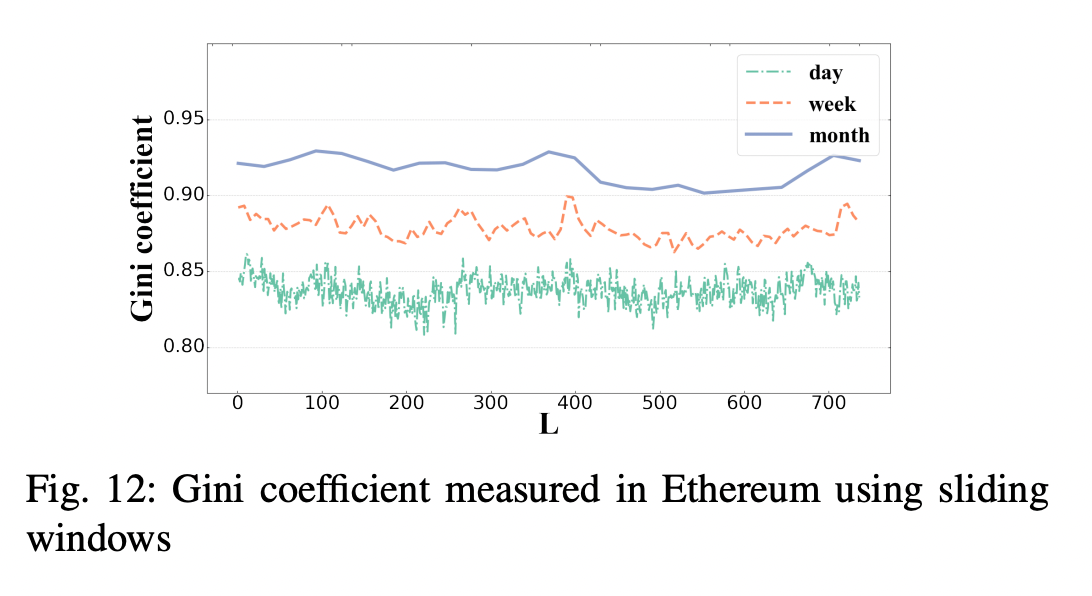

- Bitcoin and Ethereum both have Gini coefficients of > 0.80. This means that the ownership distribution of these cryptocurrencies is significantly more unequal than fiat.

- While there's no hard data on the returns for Robinhood users, retail investors, on average, lose money. So while many retail investors profited from the GameStop short squeeze, it's possible that hedge funds made significantly more money on the trade (except for Melvin Capital).

While I don't think this disproves securitization as a reaction to inequality, the key statistic missing is to whom these returns accrue. Usually, these asset classes are only accessible to accredited investors with capital advantages. Unfortunately, many new securities have the opposite effect: they are currently inaccessible to institutional investors.

So the new era of ownership will be interesting. Will it restore balance to r = g? Or skew society further into r > g? Regardless, everything will be securitized.